Congratulations on your new MC👏! Now you are ready to hit the road but do you have at least $30,000 for each truck in your saving account? Yes, don’t be surprised, I am checking if you have $30,000 for each truck to run your business smoothly. Do you want to know the breakup or $30,000, here it is.

Why you need $30,000 per truck Cash?

| Fuel for 40 Days | $15,000 approx (considering you run 20,000 miles in 40 days and truck gives fuel economy of 6 mpg and average fuel cost is just over $4 per gallon.) |

| Driver Pay for 20,000 miles | $11,000 (Taking on low side for a $0.55 per mile) |

| Misc | $4,000 (This is assumed very least of possible on your monthly truck Payment (EMI), Salary, Admin Cost, Tax, Permits, Registrations etc) |

To understand it further, let me give you some answers in bullet point.

- You book a load on day 1.

- You will complete the load on day 3-4 based on the length.

- You will submit the paperwork same day (being very efficient) or may be next day.

- The Customer or Broker will have payment term of Net 30 (most common). It can go upto Net 45.

- Once the completed paperwork reaches customer, you will be paid via Check (most common), if so check will take another 7-10 days to arrive at your office and hit the bank. If you are paid via ACH, let’s not count those extra 7-10 days.

- So, it took around 35-40 days to get your money of the load you booked on Day 1.

- But, you will need to fuel the Truck on Day 1 to hit the road,

- You will have to pay your driver on maybe Day 7 or so for the entire week.

- And so on.

If you understand what I am trying to say here, now you know. You will need to have at least $30K on your account per truck to save your business before failing. But that is huge money and may not be the case if you are just starting up.

What is the Solution for this Cash Flow Problem for new Carriers?

There are two solutions to this problem.

- Quick Pay

- Factoring

Quick Pay

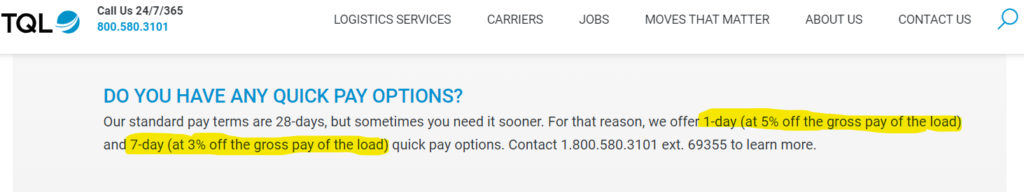

Quick Pay is very simple as name suggests. Customers or Broker will provide you option to get paid quickly by charging a certain percentage. This is normally 2%-7% depending upon the broker/customer and the time frame you choose to get paid. Also, this process is different for each broker and some might not offer the Quick Pay at all.

Factoring – Introduction of Factoring

Factoring, a carrier sells its invoices to a third party at a discount, called a factor. The factoring then gets the customer to pay the entire amount on the invoice. This is exclusive contract with you and the Factor will purchase all the invoices (based on the credit approval of broker/customer) and pay you same day or next day depending upon the submission time and process of the factoring company. For new carriers, this can be a useful tool as it can give them a much-needed boost in revenue.

Let’s understand why Factoring is needed in more detail and some aspect and process of Factoring.

Key Benefits of Using Factoring?

- Improved cash flow: Factoring can help to improve your cash flow by providing you with immediate access to cash. This can be especially helpful if you are experiencing slow payments from your customers or just starting your business and don’t have the pool of cash to spend on your day to day operations.

- Reduced administrative burden: Factoring can help to reduce the administrative burden associated with managing your accounts receivable. This can free up your time to focus on other aspects of your business. If you are using Factoring, only task you have to do is collect eligible paperwork from Drivers and submit that to Factoring. Once done, the rest tasks, eg.

- sending it to Customer with correct formatting,

- confirming if Customer/Broker received paperwork or it went to spam/junk email,

- asking when they will be paying kind of questions, all are up-to Factoring company.

- Improved creditworthiness: Factoring can help to improve your creditworthiness by showing that you have a strong cash flow. This can make it easier for you to secure financing in the future when you plan to expand the business.

- Access to working capital: Factoring can provide you with access to working capital, which can be used to invest in your business, such as purchasing new equipment or expanding your operations. As you have access to cash, you can focus on getting good paying loads, building relations with customers and running trucks without any downtime.

How does Factoring Work?

Getting a Factoring?

If this is your first time looking for factoring, the process is straight-forward.

- Decide the type of Factoring you need.

- Choose between Recourse or Non Recourse Factoring

- Search for the Factoring Companies

- Get quotations based on your revenue. This is usually in percentage.

- Check for any hidden charges.

- Uploading charges

- Customer/Broker verification charge

- Payment disbursal charges

- Account Maintenance Charges

- Factoring Fee percentage based on Volume slabs

- Check Approval process of new customer.

- Once you have figured out the correct, negotiate for further lower fees.

- Sign the Contract

- Update your Customer with Notice of Assignment and tell them to pay directly to Factoring henceforth.

Submitting Paperwork to Factor

The factoring process is relatively simple. To factor an invoice, you will need to provide the factor with following document.

- copy of the Signed Rate Confirmation,

- Proof of Delivery (POD) or Signed Bill of Lading (BOL),

- Lumper / Layover Receipts (if any),

- and the Invoice.

Getting Paid from Factoring

Once the paperwork is submitted to Factoring, they will asses for the any discrepancy in the document submitted like signature missing or different addresses in Rate Confirmation and BOL. Once they are satisfied with document, based on the submission time, they will purchase the invoice.

Factoring will deduct their fees at agreed percentage, some factoring might keep a percentage as Reserve and then fund you the remaining balance. Let’s understand a scenario by following sample calculations.

| Invoice Amount | $5,000.00 |

| Factoring Fee (2%) | $100.00 |

| Reserve (3%) | $150.00 |

| Paid Amount (95%) | $4750.00 |

What is next for Factoring Company?

As I mentioned above, now the factoring company will take care of the next steps. Including from sending paperwork to customers to following up for payment and applying received money correctly.

I hope this article about Introduction of Factoring was helpful for you. If you are new carrier and are looking for a reliable partner who can help you on Accounting, Dispatch and other day to day administrative tasks, consider YMQ Services.